40 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest

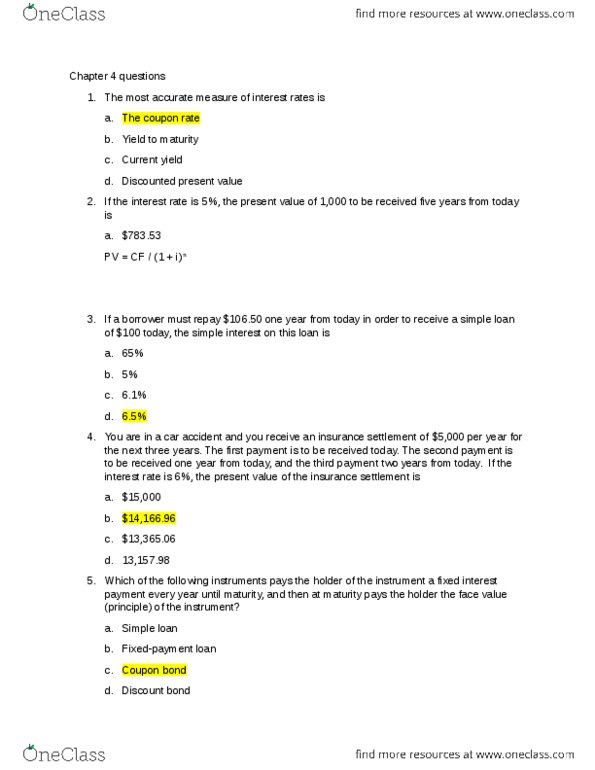

If the yield on a fixed-coupon bond goes up, does the borrower have to ... If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? Most studied answer No, the price goes down. The payments are fixed. FROM THE STUDY SET Investing View this set Other answers from study sets If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? No, the price goes down. Coupon Bond - Definition, Terminologies, Why Invest? - WallStreetMojo What is Coupon Bond? Coupon bonds are a type of bond that pay fixed interest (coupons) at a predetermined frequency from the bond's issue date to the bond's maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate, which is determined by multiplying the coupon rate by the bond ...

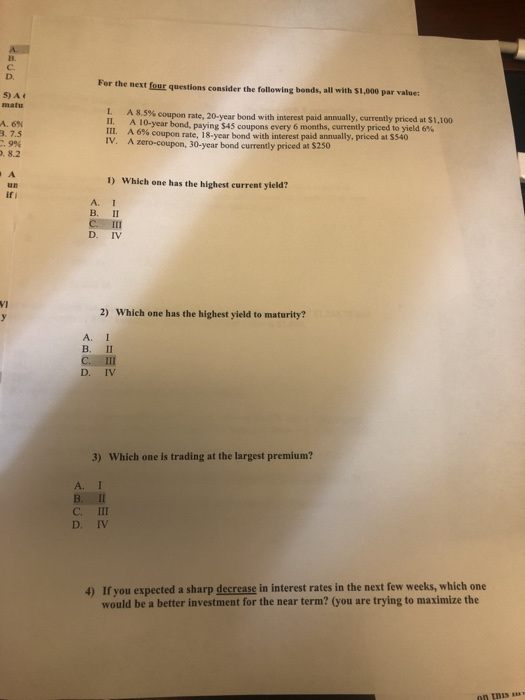

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest

› bonds › 07Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond that issues 3% coupon payments may now be "outdated" if interest rates have increased to 5%. To compensate for this, the bond will be sold at a discount in secondary market. If the yield on a fixed coupon bond goes up - AnswerData If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down. No, the price goes down. The payments are fixed. Answer Option d is the correct option No, the price goes down. Investing Flashcards | Quizlet If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? No, the price goes down. ... 4,000 million Peruvian sol. Which one of the following actors benefits when interest rates go up? An investor who is about to buy bonds. ... The bond with the highest yield if the two bonds have the same maturity date.

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest. If the yield on a fixed-coupon 'bond goes up, does the...ask 5 No,... If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? a. No, the price goes up. The yield goes up. b. Yes, the price goes down. The coupon payments go up. c. Yes, the price goes up. The yield goes down. d. No, the price goes down. The payments are fixed. Sep 16 2022 | 09:58 AM | Solved Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet A coupon is a fixed cash payment the investor is promised on a bond, usually expressed as a percent of the par value - which is also known as the principal. Yield and rate of return are both dynamic values that describe the performance of a bond over a set period of time. While the rate of return on an investment is the percentage increase ... If the yield on a fixed-coupon 'bond goes up, does the borrower have to ... If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down. No, the price goes down. The payments are fixed. 1 Approved Answer Mohammad Z answered on March 27, 2021 KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up, does the ... No, the price goes down. ...

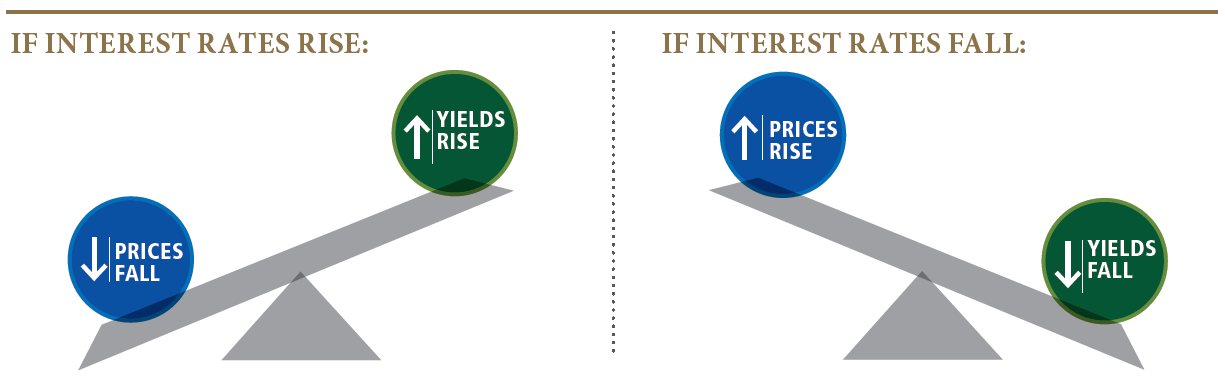

Solved KNOWLEDGE CHECK If the yield on a fixed-coupon bond | Chegg.com Question: KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? Yes, the price goes up. The yield goes down No, the price goes up. The yield goes up. No, the price goes down. The payments are fixed. Yes, the price goes down. The coupon payments go up. This problem has been solved! Bond Basics: How Interest Rates Affect Bond Yields When interest rates rise, prices of existing bonds tend to fall, even though the coupon rates remain constant: Yields go up. Conversely, when interest rates fall, prices of existing bonds tend to rise, their coupon remains constant - and yields go down. Quality matters. Not surprisingly, a bond's quality also has direct bearing on its price ... What are the four policy issues in the pay model? What...ask hint 5 If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? a. No, the price goes up. The yield goes up. b. Yes, the price goes down. The coupon payments go up. c. Yes, the price goes up. The yield goes down. d. No, the price goes down. The payments are fixed. KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up, does the ... KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? Yes, the price goes up. The yield goes down No, the price goes up. The yield goes up. No, the price goes down. The payments are fixed. Yes, the…

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia If the coupon rate on a bond is higher than its yield, the bond will be trading at a premium. This is because the fixed rate of interest on the bond exceeds prevailing interest... MCQ BMC | PDF - Scribd If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? A- No, the price goes up, the yield goes up B- Yes, the price goes down, the yield goes up C- No, the price goes down, the payments are fixed D- Yes, the price goes up, the yield goes down How much will the Peruvian government › glossary › fixed-incomeFixed Income Glossary - Common Fixed Income Terms - Fidelity coupon coupon: the interest rate a bond's issuer promises to pay to the bondholder until maturity, or other redemption event, generally expressed as an annual percentage of the bond's face value; for example, a bond with a 10% coupon will pay $100 per $1000 of the bond's face value per year, subject to credit risk; when searching Fidelity's ... D7223F5B-B2AE-489C-8162-07DB6623D3E9.jpeg - KNOWLEDGE CH... KNOWLEDGE CH ECK If the yield on a fixed—coupon bond goes up, does the borrower have to pay more interest? Yes, Study Resources. Main Menu; by School; ... KNOWLEDGE CH ECK If the yield on a fixed—coupon bond goes up, does the borrower have to pay more. ... 90 spend a little more time with the kids Paloma would fill in for him at his.

Duration: Understanding the Relationship Between Bond Prices and ... Of course, duration works both ways. If interest rates were to fall, the value of a bond with a longer duration would rise more than a bond with a shorter duration. Therefore, in our example above, if interest rates were to fall by 1%, the 10-year bond with a duration of just under 9 years would rise in value by approximately 9%.

If the yield on a fixed coupon bond goes up If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down. No, the price goes down. The payments are fixed. Answer Option d is the correct option No, the price goes down.

FIXED INCOME (BLOOMBERG MARKET CONCEPTS) What... - Course Hero If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? A- No, the price goes up, the yield goes up B- Yes, the price goes down, the yield goes up C- No, the price goes down, the payments are fixed D- Yes, the price goes up, the yield goes down C - No , the price goes down , the payments are fixed

quizlet.com › 315700564 › bloomberg-market-conceptsbloomberg market concepts Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like Inaccurately because the scope of GDP measurements can change., It went down, C= Consumer spending I = Investment (Gross Fixed Capital Formation) G= Government Spending X= Exports M= Imports and more.

Bond Coupon Interest Rate: How It Affects Price - Investopedia Most bonds have fixed coupon rates, meaning that no matter what the national interest rate may be—and regardless of market fluctuation—the annual coupon payments remain static. 2 For...

› what-are-bonds-and-howWhat Are Bonds and How Do They Work? - The Balance Jul 03, 2022 · Coupon rate: The nominal or stated rate of interest on a fixed-income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond’s face value. These interest payments are usually made semiannually. Issue date: The issue date is the date on which a bond is issued and begins to accrue interest. Maturity ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work Nevertheless, the term "coupon" is still used, but it merely refers to the bond's nominal yield. How Does a Coupon Bond Work? Upon the issuance of the bond, a coupon rate on the bond's face value is specified. The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These ...

› ask › answersWhen is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · For example, if a company issues a $1,000 bond with a 4% interest rate, but the government subsequently raises the minimum interest rate to 5%, then any new bonds being issued have higher coupon ...

› terms › bBond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo It calculates bond yield by using the bond's settlement value, maturity, rate, price, and bond redemption. read more of a bond, the denominator is the market price of the bond. The coupon rate is fixed for the entire duration of the bond as both the numerator and the denominator for the calculation of the coupon rate do not change.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

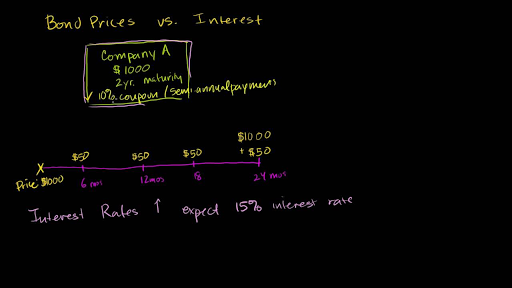

Why does the borrower pay more interest if the yield on a fixed coupon ... If the yield on a fixed coupon bond goes up, does the borrower have to pay more interest? No. When the government or a company issues a 4% coupon, 10-year bond, their obligation is fixed. You lend them $1000 and every 6 months, they pay you $20 interest. In 10 years, they pay back the $1000 and interest payments cease. That never changes.

Solved If the yield on a fixed-coupon 'bond goes up, does - Chegg If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down. No, the price goes down. The payments are fixed.

If the yield on a fixed coupon bond goes up, does the borrower have to ... As you mentioned, the coupon on a conventional government or corporate bond is fixed. A 10-year, $1000 Treasury bond with a 5% coupon pays $50 per year in interest, no matter what. So if you buy that bond for $1000—and hold it to maturity—your annual yield will also be 5%. But, in th Continue Reading Christopher Hansen

en.wikipedia.org › wiki › InterestInterest - Wikipedia For example, suppose an investor buys $10,000 par value of a US dollar bond, which pays coupons twice a year, and that the bond's simple annual coupon rate is 6 percent per year. This means that every 6 months, the issuer pays the holder of the bond a coupon of 3 dollars per 100 dollars par value. At the end of 6 months, the issuer pays the holder:

Coupon Interest and Yield for eTBs | australiangovernmentbonds What is the Coupon Interest Rate? The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

Investing Flashcards | Quizlet If the yield on a fixed-coupon bond goes up, does the borrower have to pay more interest? No, the price goes down. ... 4,000 million Peruvian sol. Which one of the following actors benefits when interest rates go up? An investor who is about to buy bonds. ... The bond with the highest yield if the two bonds have the same maturity date.

If the yield on a fixed coupon bond goes up - AnswerData If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down. No, the price goes down. The payments are fixed. Answer Option d is the correct option No, the price goes down.

› bonds › 07Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond that issues 3% coupon payments may now be "outdated" if interest rates have increased to 5%. To compensate for this, the bond will be sold at a discount in secondary market.

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

Post a Comment for "40 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest"