44 t bill coupon rate

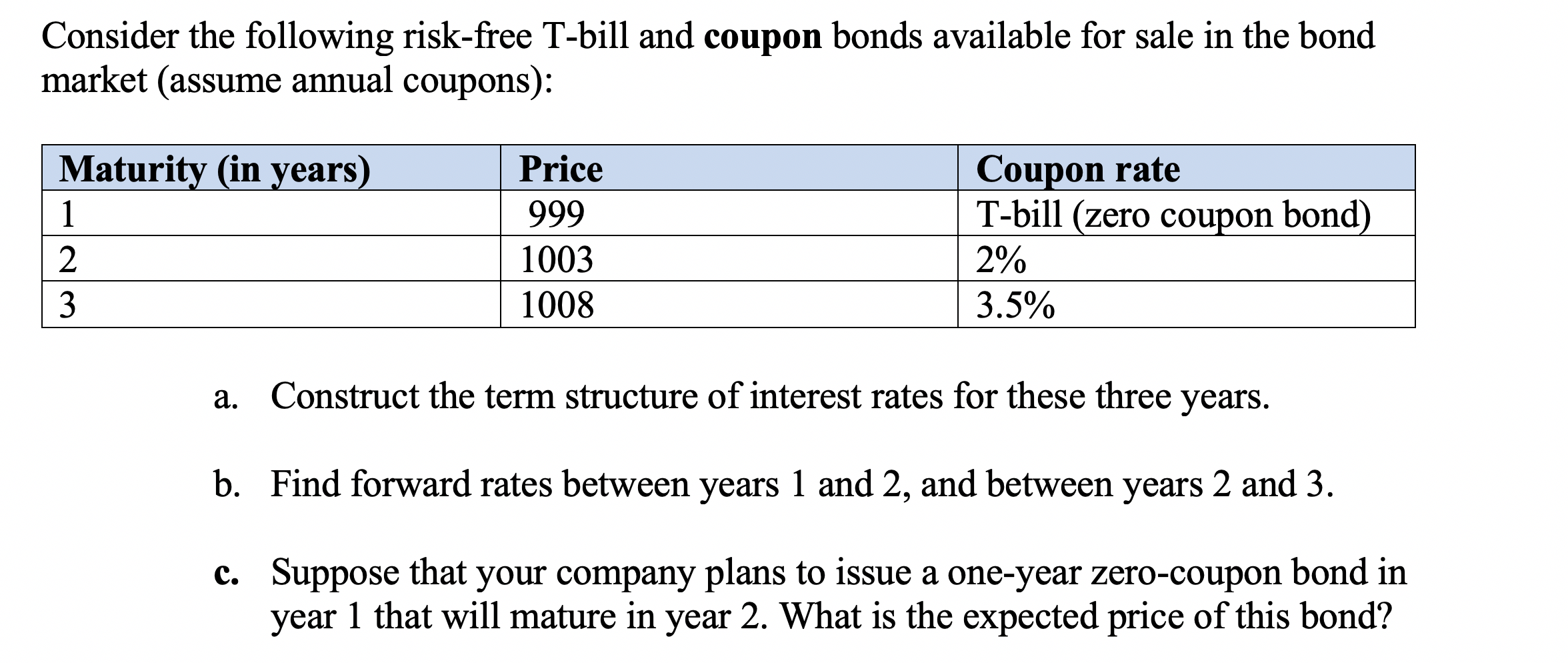

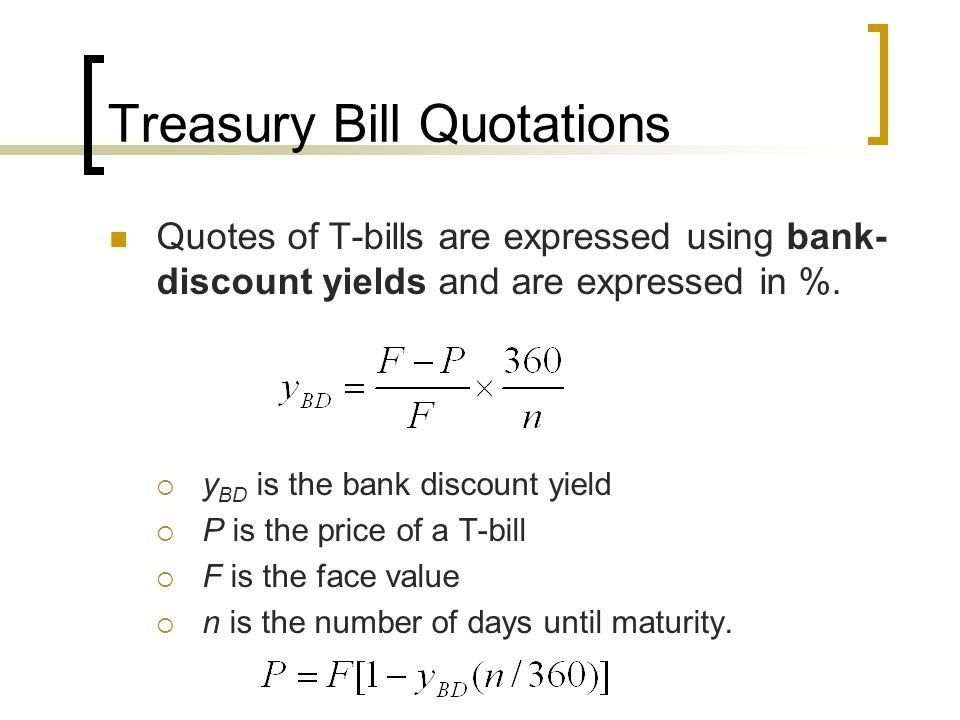

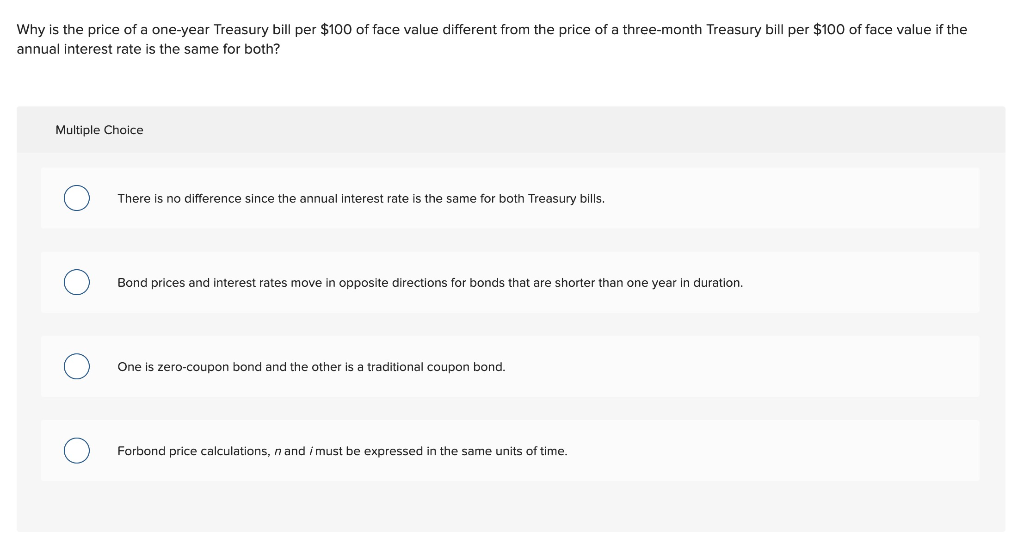

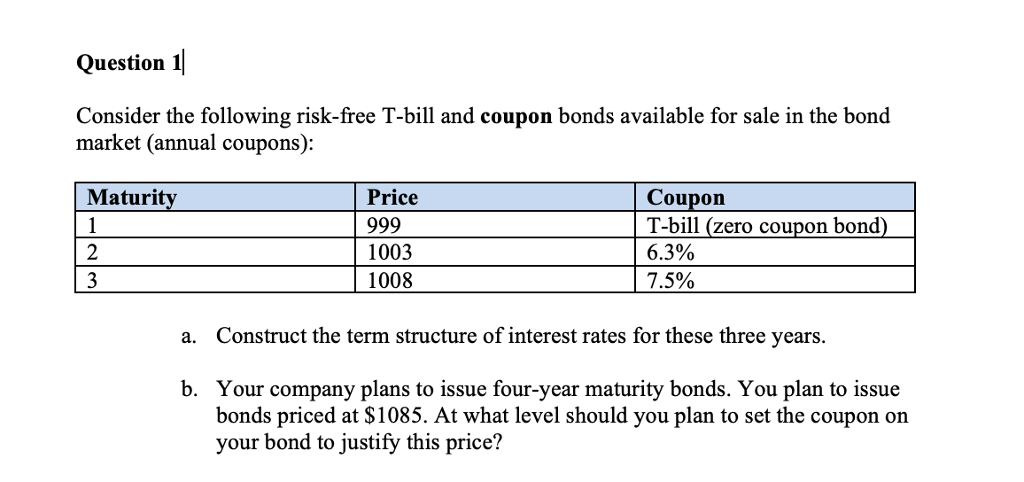

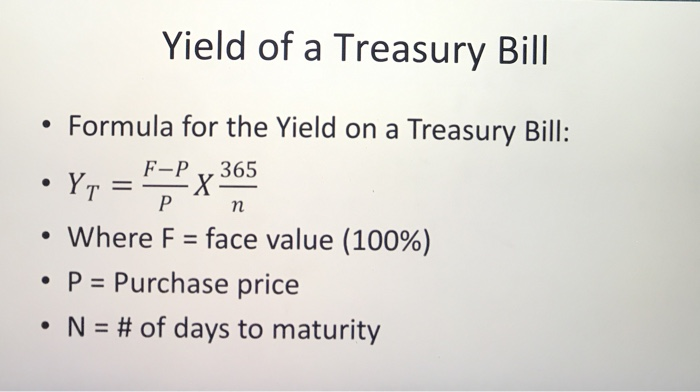

Understanding Pricing and Interest Rates — TreasuryDirect A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Coupon Rate 0.000% Maturity Oct 5, 2023 Performance Change in Basis Points Yield Curve - US Recent News MarketWatch One-year Treasury yield jumps 30 basis points to 4.53%, leading rates...

T bill coupon rate

Treasury Bills — TreasuryDirect Treasury Bills. We sell Treasury Bills (Bills) for terms ranging from four weeks to 52 weeks. Bills are sold at a discount or at par (face value). When the bill matures, you are paid its face value. You can hold a bill until it matures or sell it before it matures. Note about Cash Management Bills: We also sell Cash Management Bills (CMBs) at ... Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured. United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 1.63: 100.53: 1.51%-6 +327: 8:10 AM:

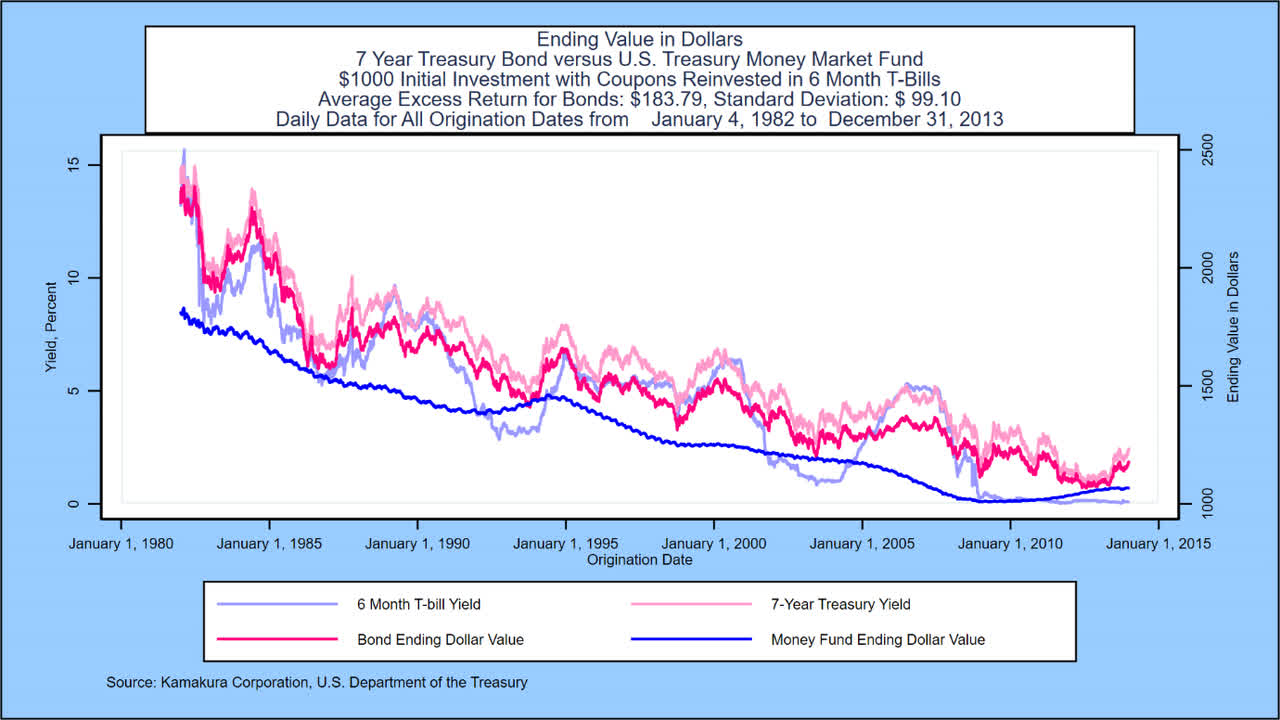

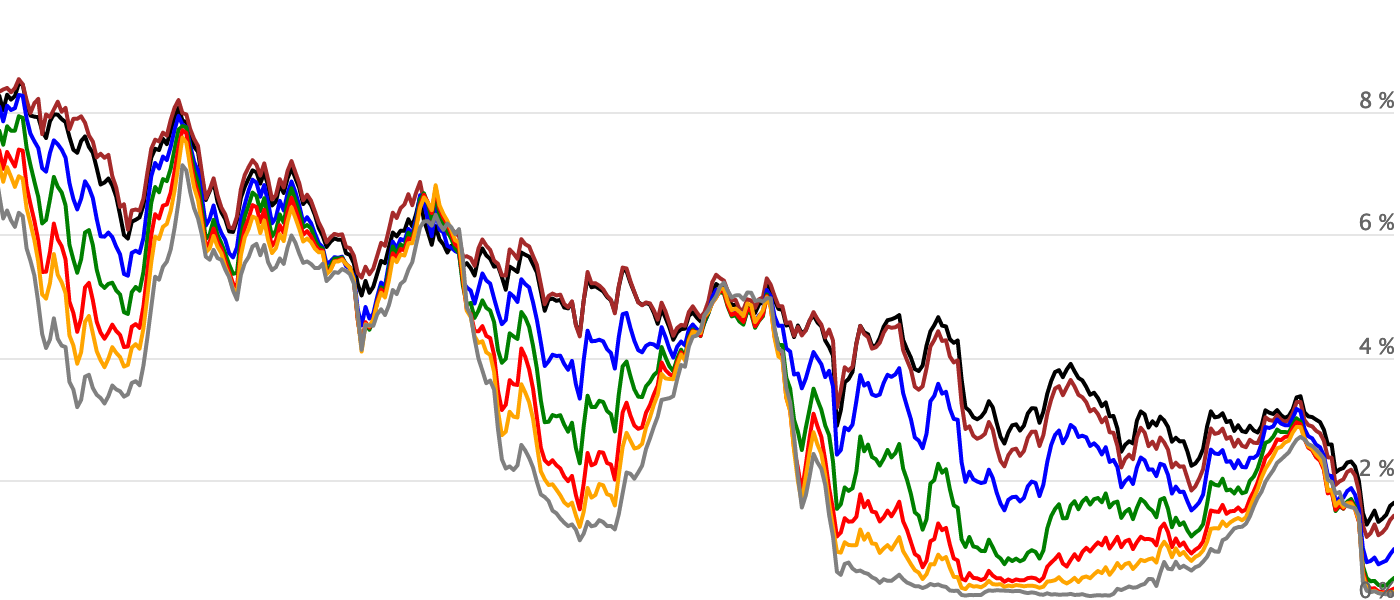

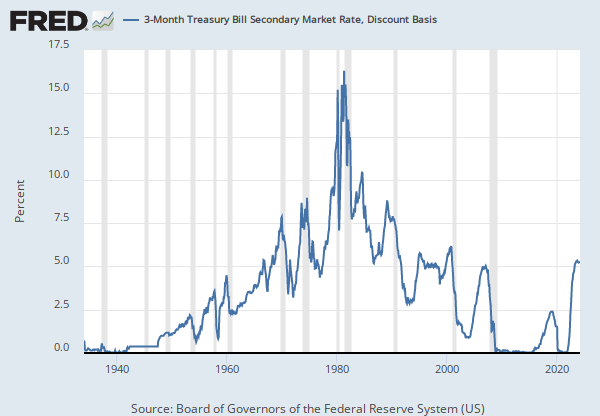

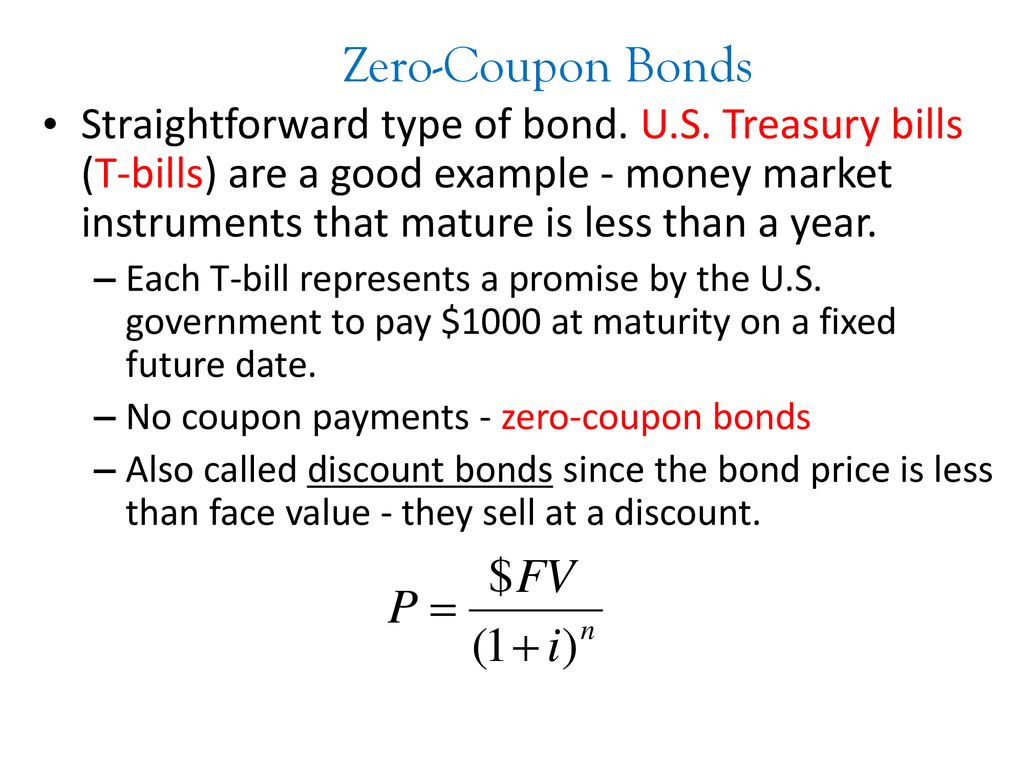

T bill coupon rate. Treasury Coupon Issues | U.S. Department of the Treasury Daily Treasury Bill Rates. ... "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016 91 Day T Bill Treasury Rate - Bankrate The difference between the discounted price and the face value determines the yield. The yield on 91-day Treasury bills is the average discount rate. How it's used: The rate is used as an... The Basics of the T-Bill - Investopedia There are auctions featuring different maturities every week except the 52-week T-Bill, which is sold every four weeks. 2 For example, a T-Bill with a maturity of 26 weeks might be sold... US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

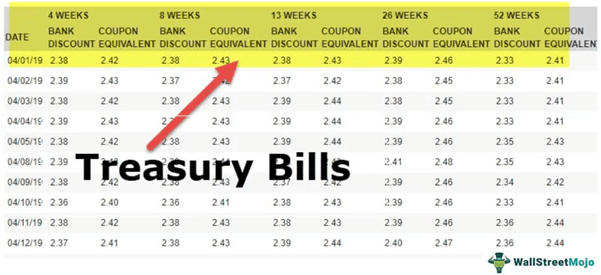

› college-footballCollege Football News, Videos, Scores, Teams, Standings ... Get NCAA football news, scores, stats, standings & more for your favorite teams and players -- plus watch highlights and live games! All on FoxSports.com. Treasury Bills Statistics - Monetary Authority of Singapore SGS T-bill Yield Curve. 6 12 Tenor (Months) 2.870 2.875 2.880 2.885 2.890 Yield (%) Latest Yield. Previous Week. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change. Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). Are T-Bills "coupon equivalent" rates based in annual terms? 1 According to treasury.gov, the "coupon equivalent" for a 1 month (4 weeks) T-Bill issued today is 0.99%. I happened to have purchased a 1 month T-Bill today for $99.9246. By my calculation that means that the return will be .075% (.0754/99.9246) for the month.

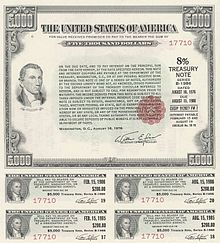

Understanding Treasury Bond Interest Rates | Bankrate The semiannual coupon payments are half that, or $6.25 per $1,000. If you have a TreasuryDirect.gov account and use it to buy and hold U.S. Treasury securities, the coupon interest payments are... TMUBMUSD06M | U.S. 6 Month Treasury Bill Overview | MarketWatch Coupon Rate 0.000%; Maturity Apr 27, 2023; Performance. 5 Day: 10.80; 1 Month: 77.83; 3 Month: ... Most Treasury yields fell on Thursday, while rates on 3- and 6-month Treasury bills swung in both ... The 5 Best T Bill ETFs (Treasury Bills) To Park Cash in 2022 The 5 Best T Bill ETFs. SHV - iShares Short Treasury Bond ETF. BIL - SPDR Bloomberg Barclays 1-3 Month T-Bill ETF. GBIL - Goldman Sachs Access Treasury 0-1 Year ETF. CLTL - Invesco Treasury Collateral ETF. SGOV - iShares 0-3 Month Treasury Bond ETF. Where To Buy These T Bill ETFs. T-bills: Information for Individuals - Monetary Authority of Singapore What It Is Good For. Use T-bills to: Diversify your investment portfolio. Receive a fixed interest payment at maturity. Invest in a safe, short-term investment option. The price of SGS T-bills may rise or fall before maturity. If you want the flexibility of getting your full investment back in any given month, consider Singapore Savings Bonds ...

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

coupon rates on Tbills bought through nd in my fidelity ira coupon rates on Tbills bought through nd in my fidelity ira. By Terry Savage on October 28, 2022 | Chicken Money. Novice at purchasing t bills. I saw i can buy a variety of tbills in my Fidelity Ira, but am confused what is the difference when coupon rates vary from zero to 2 or 3 % with the same yield in some cases, Which are better .

Treasuries - WSJ U.S. Treasury Quotes Friday, September 30, 2022. Treasury Bills. Treasury note and bond data are representative over-the-counter quotations as of 3pm Eastern time. For notes and bonds callable ...

US T-Bill Calculator | Good Calculators Treasury Bills are normally sold in groups of $1000 with a standard period of either 4 weeks, 13 weeks, or 26 weeks. Using our US T-Bill Calculator below you are able to select the face value of your bonds using the drop down list of common values, or you may enter an alternative value that isn't listed in the "Other Value" box.

abcnews.go.com › USU.S. News | Latest National News, Videos & Photos - ABC News ... Oct 26, 2022 · Get the latest breaking news across the U.S. on ABCNews.com

US Treasury Bill Calculator [ T-Bill Calculator ] The annual percentage profit rate based the period of the treasury bill investment The annual interest rate of your T-Bill is calculated for information only. For example, you buy a $5000 T-Bill for $4800 over three months. Your profit is $200, the rate of return is 4.17% Calculations can be saved to a table by clicking the "Add to table" button

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Price & News - WSJ -0/32 (-0.17%) 1 Day Range 4.615 - 4.632 52 Week Range (Yield) -0.376 - 4.733 (01/05/22 - 10/21/22) Coupon Maturity 10/05/23 1 D 5 D 1 M 3 M YTD 1 Y 3 Y Yield Open 4.632 Prior Close (Yield) 4.632...

› communities › northNorth County - The San Diego Union-Tribune News from San Diego's North County, covering Oceanside, Escondido, Encinitas, Vista, San Marcos, Solana Beach, Del Mar and Fallbrook.

Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized,...

› credit-cardsCredit Cards - Compare Credit Card Offers | Credit.com Finding the right card isn’t easy. Thankfully, Credit.com can provide all the information you need to make an informed decision. Evaluate credit card terms and features, and get all your credit card questions answered here. Depending on the type of benefits you’re looking for, some credit cards ...

› music › music-newsMusic News - Rolling Stone Warning: if you aren't into sushi ASMR, this music video might be hard to watch. Hairy Styles By Jodi Guglielmi. Oct 27, 2022 12:41 pm

Treasury Bills - Guide to Understanding How T-Bills Work For example, a $1,000 T-bill may be sold for $970 for a three-month T-bill, $950 for a six-month T-bill, and $900 for a twelve-month T-bill. Investors demand a higher rate of return to compensate them for tying up their money for a longer period of time. Risk Tolerance. An investor's risk tolerance levels also affect the price of a T-bill.

13-Week T-Bill Rate Cash (TBY00) - Barchart.com Find the latest 13-Week T-Bill Rate prices and 13-Week T-Bill Rate futures quotes for all active contracts below. Looking for expired contracts? Check out our 13-Week T-Bill Rate Historical Prices page.

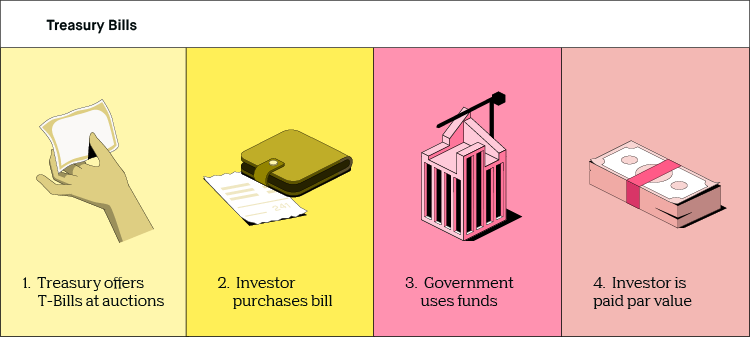

› terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? T-bills are short-term government debt instruments with maturities of one year or less, and they are sold at a discount without paying a coupon. T-Notes represent the medium-term maturities...

Your Money: How rate of return on T-Bills is calculated The quoted rate is called the discount rate. In the case of other securities, the rate is quoted on an add-on basis. Assume the same numbers. The interest on an investment of Rs 100 is Rs...

What Are Treasury Bills (T-Bills), and Should You Invest ... - SmartAsset Let's say you purchase a $10,000 T-bill with a discount rate of 3% that matures after 52 weeks. That means you pay $9,700 for the T-bill upfront. Once the year is up, you get back your initial investment plus another $300. If you're interested in investing in T-bills, make sure you aren't looking at treasury bonds or treasury notes.

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 1.63: 100.53: 1.51%-6 +327: 8:10 AM:

Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

Treasury Bills — TreasuryDirect Treasury Bills. We sell Treasury Bills (Bills) for terms ranging from four weeks to 52 weeks. Bills are sold at a discount or at par (face value). When the bill matures, you are paid its face value. You can hold a bill until it matures or sell it before it matures. Note about Cash Management Bills: We also sell Cash Management Bills (CMBs) at ...

:max_bytes(150000):strip_icc()/Treasury-yield_final-40eecf2eabbe467da15e4b7d7ea949ff.png)

Post a Comment for "44 t bill coupon rate"