44 pricing zero coupon bonds

How Premium Bonds are Priced | Zero Coupon Bond | Savings - PFhub Let's consider a zero coupon bond with a par value of $5,000 and a maturity period of 5 years. Let's assume that the required rate of return is 10%. Plugging these values in the bond pricing formula: Price = [$5,000 / (1+.05)^10] = $3069.5 Compare this price with the price of the plain vanilla bond that we calculated in the last example. The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Zero Coupon Bonds - Financial Edge Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity. Calculating the value of a zero coupon bond. What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value.

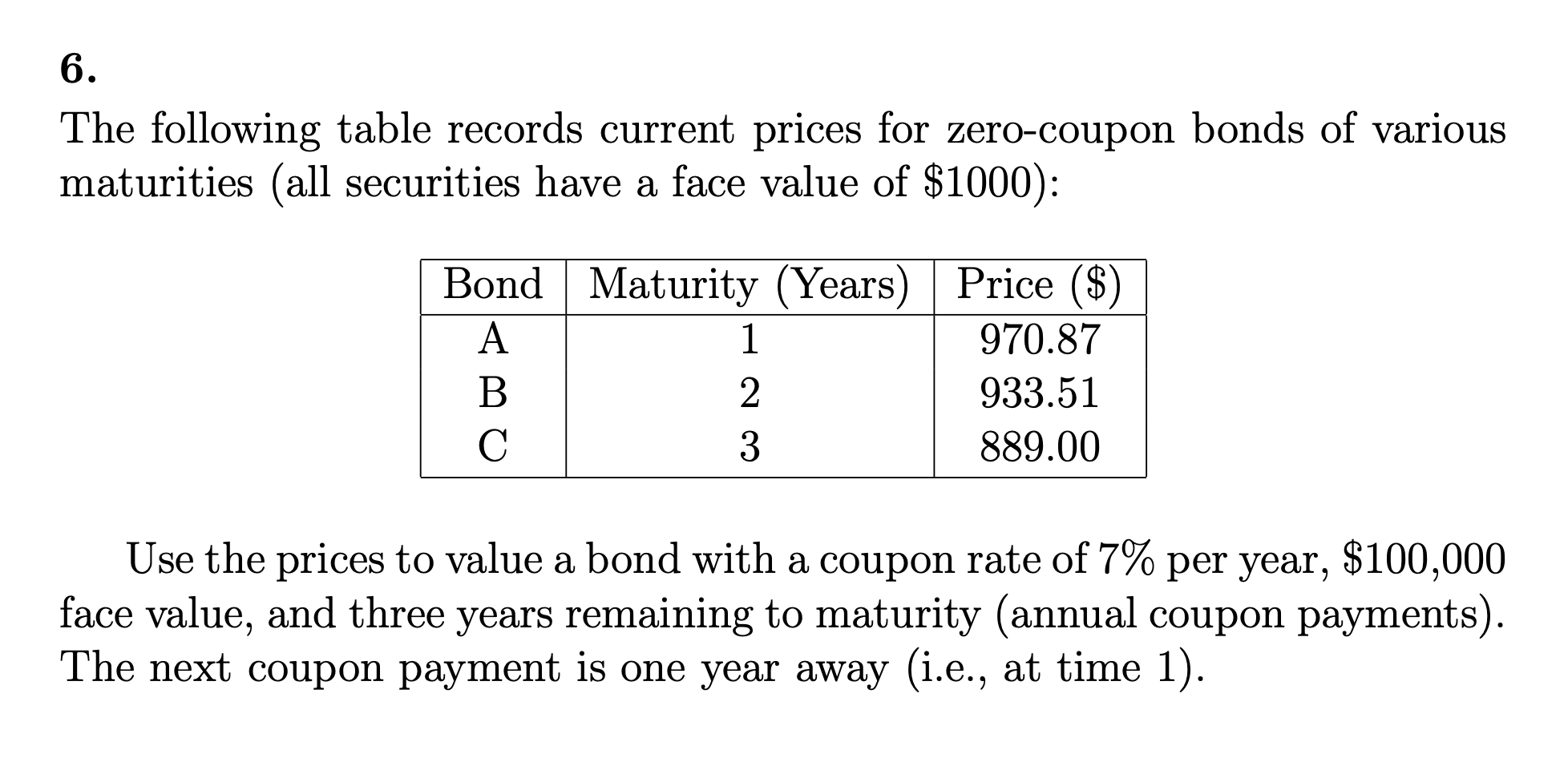

Pricing zero coupon bonds

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ... Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. How to Calculate the Price of a Zero Coupon Bond The lower the price you pay for the zero-coupon bond, the higher your rate of return will be. For example, if a bond has a face value of $1,000, you'll earn a higher rate of return if you can buy it for $900 instead of $920. Calculating Zero-Coupon Bond Price.

Pricing zero coupon bonds. Investor's Guide to Zero-Coupon Municipal Bonds Zero-coupon bonds are sold at a substantial discount from the face value. For example, a bond with a face value of $20,000, maturing in 20 years with a 5.5% coupon, may be purchased at issuance for roughly $6,757. At the end of the 20-year investment, the investor will receive the full $20,000 face value. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Zero-Coupon Bond Definition - Investopedia If the debtor accepts this offer, the bond will be sold to the investor at $20,991 / $25,000 = 84% of the face value. Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which translates... Pricing zero coupon bonds | Python - DataCamp Pricing zero coupon bonds. You have seen that the price of a zero coupon bond is simply the PV of a single cash-flow in the future. How much that single cash-flow is worth today will depend on how far it is into the future and what interest rate (yield) you discount it at. We will investigate this now. To do this, you are going to price a zero ...

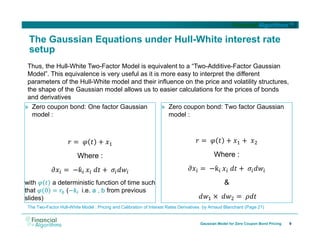

Risk-Neutral Pricing Formula for Zero-coupon bonds with Default Risk I am looking for the equations or papers showing the risk-neutral pricing for zero-coupon bonds including default risk. I already tried Googling and searching SSRN and Jstor. bond; zero-coupon; risk-neutral; Share. Improve this question. Follow asked Apr 4, 2020 at 17:02. Jake Freeman Jake Freeman. Zero Coupon Bonds Explained (With Examples) - Fervent The value of a zero coupon bond is nothing but the Present Value of its Par Value. Zero Coupon Bond Example Valuation (Swindon Plc) Consider an example of Swindon PLC, which is issuing a zero coupon bond with a par value of £100 to be paid in one year's time. What is the price of this bond today, if the yield is 7%? Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Perhaps the most familiar zero-coupon bonds for many investors are the old Series EE savings bonds, which were often given as gifts to small children. These bonds were popular because people could... Zero Coupon Bond: Formula & Examples - Study.com Purchase a $10,000 Zero Coupon Bond from Company X that matures in 5 years. According to the latest quote, the $10,000 Zero Coupon Bond of Company X is trading at $9,110. You thus have a decision...

Government - Continued Treasury Zero Coupon Spot Rates* 3.06. 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot ... Zero Coupon Bonds: Know tax rules when such a bond is held till ... As the coupon rate of a zero coupon bond is zero per cent, people investing in such bonds don't get regular interest, but get a deep discount on face value at the time of issuance of such a bond ... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Zero Coupon Bond Calculator - Nerd Counter There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. So, the under the given procedure will be applied to have the demanded answer easily: $4000 (1+.3)20; $4000; 190.049637748; $21.05

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... The price of zero-coupon bonds is calculated using the formula given below: See also How to Calculate Bond Premium or Discount? (Explained) Price = M / (1 + r) ^ n, where M = maturity value of the bond. (In other words, the face value of the bond) R = required rate of return (or interest rate) N = number of years till maturity

How to Buy Zero Coupon Bonds | Finance - Zacks The less you pay for a zero coupon bond, the higher the yield. A bond with a face value of $1,000 purchased for $600 will yield $400 at maturity. Zero coupon bonds are issued by the Treasury...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

› articles › bondsHow Bond Market Pricing Works - Investopedia Aug 31, 2020 · What is the difference between a zero-coupon bond and a regular bond? 21 of 28. How Bond Market Pricing Works. ... The spot rate Treasury curve can be used as a benchmark for pricing bonds.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ...

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac{P}{(1+r)^t} where: P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool.

Bond Pricing - Formula, How to Calculate a Bond's Price A zero-coupon bond pays no coupons but will guarantee the principal at maturity. Purchasers of zero-coupon bonds earn interest by the bond being sold at a discount to its par value. A coupon-bearing bond pays coupons each period, and a coupon plus principal at maturity. The price of a bond comprises all these payments discounted at the yield to ...

Pricing of zero-coupon bond options - Big Chemical Encyclopedia The zero-correlation (y = ) price of a coupon bond option with a moneyness 1.14 is about 1.7 times as high as the corresponding option price obtained by a perfect correlation stnjcture (y = 0). The corresponding zero-coupon bond option price is about 60 times as high as its perfect correlation equivalent. [Pg.89]

How to Calculate the Price of a Zero Coupon Bond The lower the price you pay for the zero-coupon bond, the higher your rate of return will be. For example, if a bond has a face value of $1,000, you'll earn a higher rate of return if you can buy it for $900 instead of $920. Calculating Zero-Coupon Bond Price.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ...

Post a Comment for "44 pricing zero coupon bonds"